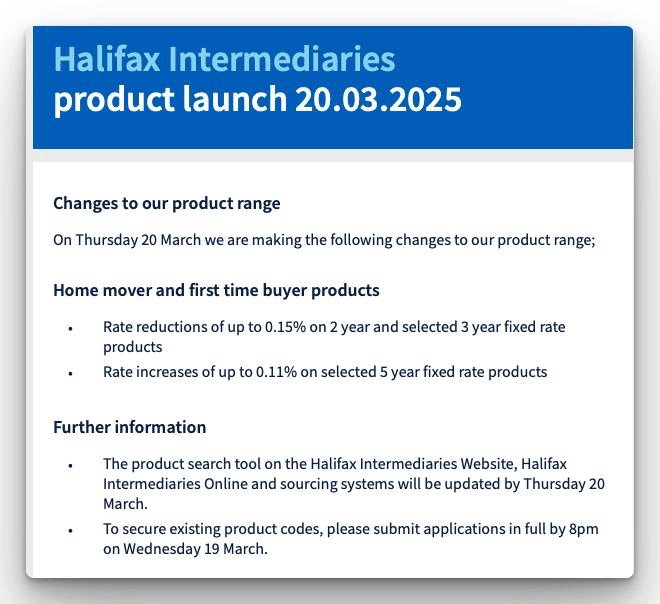

Halifax has announced rate reductions of up to 0.15% on 2-year and selected 3-year fixed rate products, while increasing rates by up to 0.11% on selected 5-year fixes.

Meanwhile, BM Solutions has announced selected buy to let rate cuts of up to 0.33% but increased rates on selected 5-year fixed remortgages by up to 0.31%.

Newspage asked brokers for their views, below.

Sean Horton, Managing Director at Respect Mortgages said, “This is classic swap rate signalling. Lenders see better value at the short end of the curve, suggesting markets expect base rate cuts this year but are less sure about 2026 onwards.

“The split pricing tells us banks reckon inflation might prove stubborn in the medium term. For borrowers, this creates an interesting dilemma – grab a cheaper two-year deal now but risk higher rates when remortgaging, or pay more for five-year security? Expect more lenders to follow suit. The message is clear: short-term certainty but longer-term caution. Smart borrowers should think carefully about their risk appetite, affordability and future plans before being lured by those headline two-year rates.”

Emma Jones, Managing Director at Whenthebanksaysno.co.uk added, “This pricing seems to suggest the Halifax is expecting rate cuts in the near term but is less sure about the direction of the base rate longer term. If you want longer term pace of mind, you’ll have to pay slightly more for it based on these changes. Ultimately, whether you opt for a 2-year or a 5-year fix comes down to multiple factors, so it’s important to get advice. Rates are once again proving choppy in an unpredictable market. All eyes are now on tomorrow’s Bank of England rate decision.”

David Stirling, Director at Mint Mortgages & Protection said, “An interesting rebalance of rates from Halifax and their buy-to-let arm BM Solutions. The change in the lender’s opinion must be guided by underlying borrowing costs, as this see-saw of short versus longer term borrowing rates turns on its head. It’s good to see some change in the marketplace as other providers put out more competitive 5 year fixes while Halifax are hunting down the 2 and 3 year applicants.”

Pete Mugleston, Mortgage Advisor & Managing Director at Online Mortgage Advisor said, “Halifax and BM Solutions adjusting their rates – cutting shorter-term deals while increasing five-year fixes – suggests lenders are responding to shifting market sentiment.

“The preference for cheaper 2- and 3-year deals aligns with expectations rates may fall in the coming years, making longer-term fixes less attractive for borrowers. Other lenders may follow suit, especially as swap rates fluctuate. While this benefits those looking for short-term flexibility, it puts pressure on borrowers seeking long-term stability. The market is adjusting to potential rate cuts, but how far and fast they come remains uncertain, making expert advice more crucial than ever.”

Steve Humphrey, Adviser & Founder at The Mortgage Pod added, “Rate reductions are always welcome, and it’s great to see Halifax and BM Solutions leading the way. The mortgage market is highly competitive right now, and hopefully, lenders will continue the rate war, benefiting borrowers with better deals. With the rise in longer-term fixed-rate products, the gap between the pricing of 2-year and 5-year deals is narrowing further.”

Justin Moy, Managing Director at EHF Mortgages said, “This is interesting repricing by both lenders. While Swap rates have been somewhat erratic over the past few weeks, the increase in popular 5-year fixed deals will be a blow to many landlords who maximise what they can borrow through these longer-term deals, important for those buying or refinancing to new lenders in particular. There may be some balancing of lending volumes behind the scenes causing these changes, but some borrowers will feel a little disappointed with these announcements.”

Dariusz Karpowicz, Director at Albion Financial Advice added, “Market signals emerge as Halifax adjusts its mortgage strategy. Halifax and BM Solutions’ recent rate adjustments – reducing shorter-term products while increasing five-year fixed rates – potentially signals a significant shift in lender positioning and market expectations.

“This recalibration from one of the UK’s largest mortgage providers suggests a market anticipating medium-term rate reductions. The preference for offering competitive shorter-term products indicates lenders’ confidence in potential Bank of England rate cuts within the next 2-3 years.

“However, the premium placed on five-year security reflects ongoing economic uncertainty amid challenging fiscal conditions. Borrowers face a calculated decision between immediate savings on shorter fixes versus longer-term certainty at a higher price point – a decision increasingly influenced by wider economic indicators and swap rate movements.”

Leave a Comment